I found the “appetite” to do a post after a

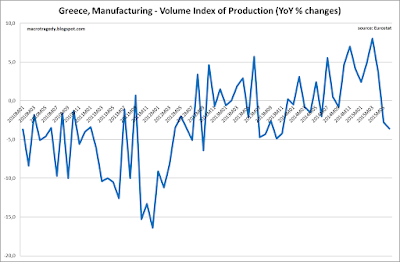

really long time. What puzzled me these past few months was the rise in Greek manufacturing

production the first few months of 2015 (until April at least that is). Of course

this seemingly dry issue has some quite important implications on which I’ll

touch later in the post.

|

| source: Eurostat |

The reason I was puzzled was that SITC

(Standard International Trade Classification) data showed industrial exports to

be falling in volume and domestic demand is rather anemic to justify such

robust increases. Since I use Industrial Production and not Turnover, Volume

data have to be used for comparisons and conclusions reached to be meaningful. SITC data literally refer to volume since they

are expressed in kgs.

I summed up some industrial goods categories

(namely, Chemicals and related products, Manufactured goods classified chiefly

by material, Machinery and transport equipment and Miscellaneous manufactured

articles) to reach the figure shown in the chart below and which I dub “Broadly

Defined Industrial Products”. Not very creative, I know.

|

| source: Eurostat, own calculations |

Last night I had an epiphany and checked data

from one of the other trade classifications, namely BEC (Broad Economic

Categories). Data from BEC justified the robust increases in Industrial

Production since they showed solid increases in merchandise exports volume for

the months until April.

|

| source: Eurostat |

Generally, data from BEC and SITC coincide,

more or less, but (besides early 2015) they have showed divergences in a few

other occasions featured in the graph. I haven’t come up with an explanation

for what drives those divergences, since I am not very fluent in the

classifications’ technicalities but implications of the divergence here could

stretch beyond a technical issue. They could determine whether Euro’s

devaluation in the second half of 2014 actually had a meaningful effect on

Greek merchandise exports. Of course, falling Oil prices may have a further

deflationary effect on prices (besides domestic deflation In Greece) here and

may make apparition of this effect on value terms even harder. Well, we have a

hung jury here, BEC data say it kind of did, while SITC data say it didn’t. Of course, one might be excused to think "if the said effect was indeed meaningful wouldn't it show on both datasets?" and I would be inclined to agree there...

No comments:

Post a Comment