These days in Europe everyone is concerned about sovereign debt. The truth, that we have momentarily set aside, though is that all forms of debt when incurred in extremis have detrimental consequences.

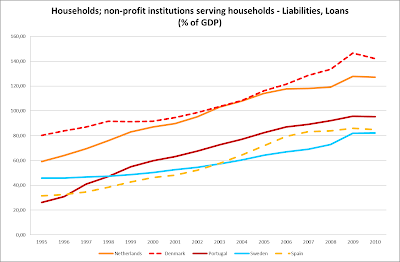

Let’s take a look at household debt. Nobody is talking about it now that interest rates are that low. It is a fact that mortgage debt comprises a much larger part of total household debt that consumer debt. It is also a fact that in many European countries, mortgages are fixed rate ones (mostly northern European countries) rather than variable rate ones (mostly southern European countries). That means that even in this low-rates environment, for countries that fixed-rate mortgages make up the most part of mortgage debt, debt service continues to be as heavy a burden for households as it was in a high rates environment and negatively affects private consumption. Here are a few charts to help us visualize that.

|

| source: Eurostat |

|

| source: Eurostat |

As we can see from the charts, retail sales in countries with relatively low household debt perform better than the EA17 average, while retail sales in countries with high household debt burdens underperform relatively to the EA17 average. For all the countries plotted in the charts, the vast majority of mortgages are of the fixed-rate variety, so comparisons shouldn’t be problematic in that respect.

Another fact is that US households seem to deleverage at a much faster pace than EU ones. Moreover, the households in some of the most indebted EU nations are significantly more indebted than the US ones. Here are the charts. Unfortunately, there was no aggregate figure for the EU so I plotted data for the most indebted EU nations.

|

| source: Eurostat |

|

| source: Federal Reserve Bank of St. Louis, own calculations |

Now I want to take a look at retail sales for EU27 and the US. Here’s the chart.

|

| source: Eurostat, Federal Reserve Bank of St. Louis |

Of course, as far as the first months of the “recovery” are concerned, the US outperforming the EU27 should be attributed to the low base effect at work, since at the height of the crisis the fall in retail sales in the US was much greater than that in the EU27. What about the months after the low-base effects ran its course though? One part of it can be explained by the chaotic household saving rate differential between the two areas.

|

| source: Eurostat, Federal Reserve Bank of St. Louis |

Can this vast outperformance of US retail sales over EU27 ones be attributed to the differential in savings rates or does the fact that US households deleverage that faster play its part ? I can’t help but wonder…

P.S. I forgot to put on the chart about household debt for all EU countries. Since data for 2010 were not available for all the countries I used 2009 data.

P.S. I forgot to put on the chart about household debt for all EU countries. Since data for 2010 were not available for all the countries I used 2009 data.

|

| source: Eurostat |