There is an argument making the rounds lately, to be more specific, that government expenditures in Greece are pretty high as a % of GDP but that the same goes for other EU countries. Funnily enough, this is not that far from the truth. Here’s the relevant chart:

|

| source: OECD |

But relying solely on this data point to build an argument is simply wrong, since it ignores the other side of the coin, namely government revenues. I’m not talking about the cost of raising debt, I’m wondering whether iax revenues can support this level of public spending.

Here’s the data for personal income tax and taxes on income and profit as a % of GDP. Greece, is easily at the bottom of the table. Translation, in order to have similar levels of government outlays you need to have at least comparable levels of government revenues.

Tax revenues for Greece are exceptionally low, something that hints of a quite large informal sector.

|

| source: OECD |

|

| source: OECD |

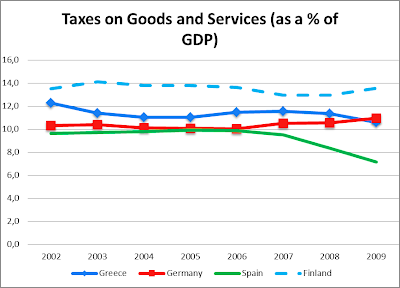

To make up for low income tax revenues, Greece taxes more heavily goods and services, something that allows the government to indirectly tax a bit of the informally generated income. I had talked about that in an older post.

|

| source: OECD |

Of course this lag in government revenues leads to a larger government deficit for Greece. If this was the only issue for Greece, it would be fine (well maybe not). The way that the government balance is calculated was altered this year and there was not one but two upward revisions of the deficit , the second of which is not recorded in the data that comprise the following graph. I don’t know if this affects data for previous years, but I’m sure that OECD wouldn’t include them if that was the case.

|

| source: OECD |

Of course, the other countries also ran deficits for almost the whole length of the time span pictured in the following graph, even ultra-prudent Germany. To be fair, of those pictured, the country with the best fiscal performance was Spain. This puts into question the whole European model of a “relatively” large state, now doesn’t it?

First of all, never forget that deficits do not only rise due to lack of tax revenues and this is an answer to the German deficit. Deficits could result from public investment and this is why UK does not calculate them in its national deficit. Furthermore, the drop of tax revenues in Greece at the moment does not result only from the big size of the illegal economic activities but also from the general drop of the legal economic activities (consumption, private investments etc.).

ReplyDeleteI agree with you on all points but they are a bit theoretical...If you look at Greek State Budgets you will notice that public investments are negligible when compared with expenditures...second, if you look closely at the charts you will notice that 2010 is not included in them and that Greek tax revenues as a % of GDP are flat and not falling...I am not talking about the effects of austerity here but rather about structural issues...

ReplyDeleteI think that I need to clarify what I mean about state budgets...it is true that the public investment program deficit is about equal to the primary deficit...but as I said above as a figure it is negligible compared to expenditures and revenues...hence if only a small part of the informal sector revenues were taxed (especially if u consider how low Greek income tax receipts are as a % of GDP)then the said deficit would be eliminated...

ReplyDeleteNever forget that a lot calculate the public investements as public expenditures. I agree about the taxation of the informal sector would definately eliminate the deficit in the Greek case. But that requires a whole set of regulations and the enforcement of those regulations. And of course, the elimination of the power of the syndicalism in the Greece (the way it has recently formed has provoked many problems to the manage of developmental economic activities). In my opinion this is one of the biggest obstacles to the development process of Greece.

ReplyDeletePublic investments are not part of the primary balance though...and the government aims for a primary surplus, that's why the Germans talk about more tax revenues.....

ReplyDeleteI totally agree with you on the unions front..another idea that started in order to favour workers and ended up doing the exact opposite...but that's human nature, power always corrupts....I hope that the government finds a way to shut out the unions but they won't go out without a fight...and theur fight only deepens the recession and further undermines efforts to attract Foreign Direct Investments (FDI) in Greece...as if we ever stood a chance...some really deep reforms in public sector functions are needed but above all people's mindset need to change...and that can't happen overnight....unfortunately...